Technology & Real Asset Investment Funds

Global Institutional Partners

Global Partners

Taronga Ventures sources, secures and invests into scalable technology and innovation that solves the challenges of institutional real asset owners and operators.

The RealTech Ventures Funds are focused on investing in strategic opportunities, providing our institutional partners first mover advantage, whilst maintaining a focus on creating a better built environment, through sustainable and responsible investment practices.

Emerging technology accelerating structural industry shifts

We invest into emerging technology companies that address structural industry shifts, enhancing current portfolio returns and allowing real asset owners and investors to experience the benefits that technology can deliver.

What is RealTech?

RealTech is any technology or innovation that impacts real estate and the built environment. It shapes the way we work, live and play.

energy, utilities

& infastructure

environment, social & governance (esg)

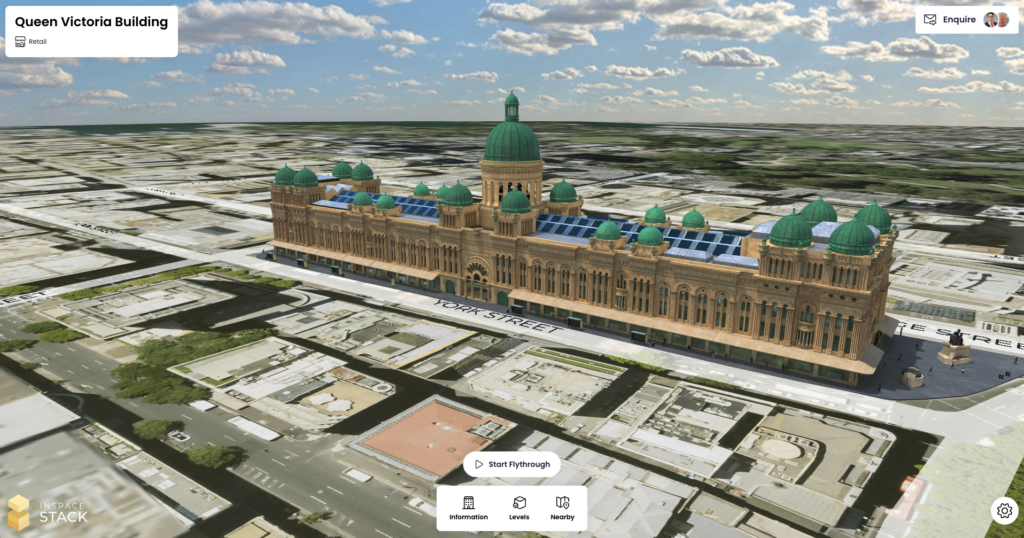

smart assets & cities

logistics & mobility

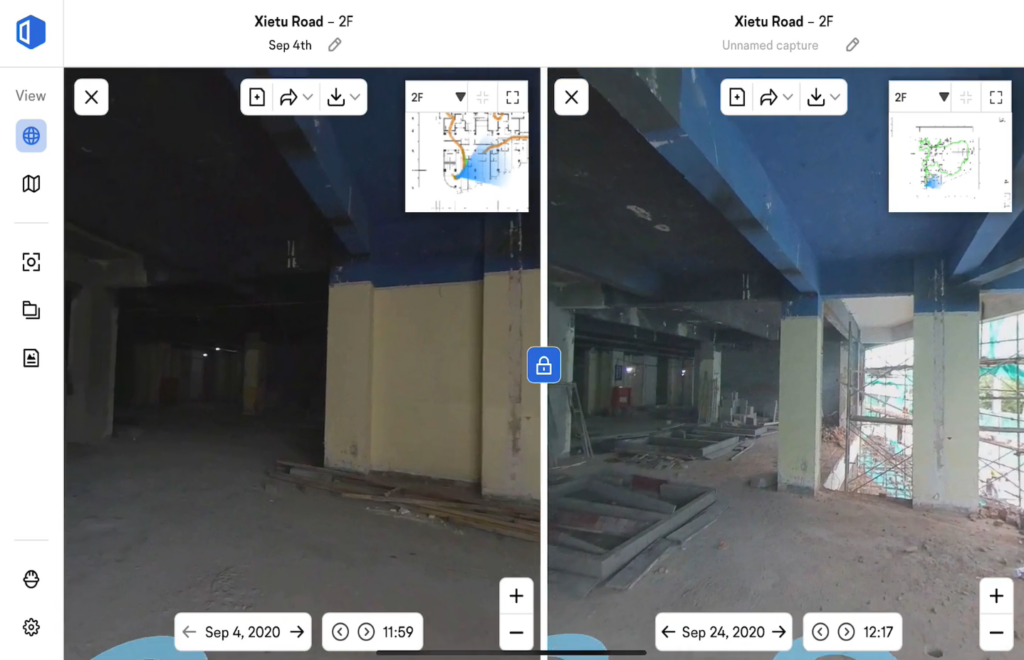

digital construction

data analytics & insights

capital & transactions

asset & portfolio management

What is RealTech?

RealTech is any technology or innovation that impacts real estate and the built environment. It shapes the way we work, live and play.

Emerging technology accelerating structural industry shifts

We invest into emerging technology companies that address structural industry shifts, enhancing current portfolio returns and allowing real estate owners and investors to experience the benefits that technology can deliver.

Innovation Portfolio

We invest into RealTech companies that provide solutions across the built environment and throughout the asset lifecycle.

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Proprietary advantages

Our investors benefit from an integrated model of domain expertise, comprehensive venture due diligence and aligned implementation skillsets to deliver innovation from opportunity through to outcomes in their portfolios.

Case Studies

View select case studies of how our partners have benefitted from implementing our innovations across their portfolios.